YouTube TV tests a slimmer play for sports fans

Streaming bills keep creeping up, and the big, one-size-fits-all TV bundle is starting to look dated. Industry chatter now points to a new move: a dedicated "Sports & Broadcast" package from YouTube TV, aimed at viewers who mostly want live games and the major networks without paying for dozens of extra channels they never watch.

Here’s the basic idea, based on what’s being discussed: a streamlined plan that leans on essential broadcast networks alongside a curated mix of sports programming. Think of it as a more focused alternative to the current base plan that carries well over 100 live channels. It wouldn’t try to be everything for everyone. It would try to be the right-sized bundle for sports-first households.

The timing is telling. YouTube TV just wrapped a tense carriage negotiation with Fox that briefly put some channels at risk. Fox’s portfolio complicates deals because live-sports staples like FS1 and FS2 are tied at the hip with non-sports networks such as Fox News and Fox Business. Untangling that mix is never easy, and it’s one reason platforms look for new packaging levers.

We’ve seen this movie before. Four years ago, YouTube TV stared down NBCUniversal and Disney in public disputes; the Disney standoff even caused a short blackout for subscribers. These fights usually end with higher programming costs that flow through to subscribers. A sports-centric bundle is one way to keep a lid on pricing for people who mainly care about games and local broadcasts.

There’s another clock ticking: more content renewals loom. With big contracts cycling, this is the window to redraw tiers, test skinnier bundles, and offer add-ons that capture superfans without forcing every household to foot the bill.

What a 'Sports & Broadcast' bundle could look like—and why it matters

While details aren’t locked, the concept points to a few likely features:

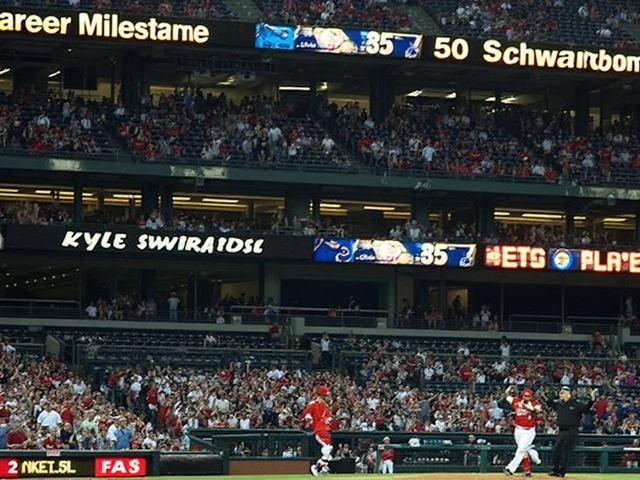

- Core broadcast networks prioritized, which is key for the NFL, college football, marquee events, and local news.

- A targeted slate of sports channels, shaped by what carriage contracts allow.

- Fewer entertainment and niche cable networks to keep costs down.

The package would sit alongside YouTube TV’s existing options, not replace them. The base plan today includes unlimited DVR, Key Plays View for quick highlights, support for six household accounts, and three simultaneous streams. Those features have been big selling points, and it would make sense to carry most of them into a sports-first tier so fans don’t feel short-changed.

What about NFL Sunday Ticket? That add-on has become a crown jewel for YouTube and YouTube TV. For 2025, returning customers can pay $47.25 per month, and new customers can pay $276 upfront. It’s reasonable to expect Sunday Ticket to remain available as an add-on regardless of which live-TV tier you pick, because that product is designed to ride on top of any base plan.

The biggest unknown is price. The whole pitch only works if the monthly bill undercuts the full-fat bundle in a meaningful way. But sports rights are expensive, and programmers often bundle channels together in contracts. That’s why a "sports" tier sometimes ends up carrying non-sports channels—because the rights holders demand it. The Fox suite is a textbook example.

Even with those guardrails, a tighter package has real appeal. Plenty of people want local NFL, college football, key soccer matches, the NBA, and MLB postseason access, but they don’t care about a long tail of lifestyle and niche channels. If YouTube TV can keep broadcast networks in the mix and lock in the right sports feeds, it could cover most of the tentpole events without the bulk.

Competition is already moving this direction. DirecTV’s My Sports skinny bundle comes in at $70 a month after new-customer discounts. Fubo has built its entire brand around being sports-first. Sling lets you tack on sports packs to a lighter base. Hulu + Live TV still leans on a broader bundle but fills it out with on-demand and sports rights. Nobody has cracked the perfect balance yet, which leaves room for a sharper play from YouTube TV.

One big wrinkle is local stations. Carriage rights for ABC, CBS, Fox, and NBC can differ market by market, often running through affiliate station owners who cut their own deals. Any sports-led bundle will live or die on whether it reliably includes the local broadcast feeds your team actually plays on. If your market lacks one of the majors, you feel it on Sunday and in March.

There are also technical features to consider. YouTube TV has made a name with Multiview and Key Plays View, which make live sports easier to follow. If those tools are part of the sports bundle, it strengthens the pitch. If they’re walled off as a premium upcharge, the value case gets murkier.

Behind the scenes, contract rules could shape everything. Programmers often insert minimum household penetration requirements, which force a service to place certain networks in widely distributed tiers. "Most-favored nation" clauses can also limit how differently a distributor can package or price channels compared with rivals. The upshot: even a sports-first package might carry a couple of channels that don’t look like sports on the surface.

So where does this leave the broader market? We’re inching toward more a la carte control without fully getting there. Sports remain the glue holding together live TV bundles, but rights costs keep rising. Creating a sports-and-broadcast tier lets a service chase two goals: keep sports fans happy at a lower price point and reduce churn by matching people with better-fit plans.

For leagues and networks, reach is the watchword. Big games need to be easy to find, and a focused sports bundle on a top vMVPD keeps that door open. For consumers, the trade-offs are clearer: a lower bill and a cleaner channel list, with the chance you’ll miss a non-sports network you occasionally watch.

If YouTube TV moves forward, it could roll this out nationwide or start with a market test tied to specific renewals. The Fox deal is fresh, but more contracts line up in the coming period, which is the natural time to rethink tiers. Don’t expect an overnight flip; packaging changes often track the contract calendar.

Key questions still hanging out there:

- Price: How much cheaper than the base plan will it be?

- Lineup: Which sports channels make the cut, and are any non-sports networks bundled in by contract?

- Locals: Will every market get all four major broadcast networks?

- Features: Does unlimited DVR, Multiview, and Key Plays View carry over as-is?

- Add-ons: Will Sunday Ticket, league passes, or 4K streams require extra fees?

For now, YouTube TV remains a leading live TV streamer with a deep base bundle and a growing stack of add-ons. The proposed Sports & Broadcast package would give it a clearer path to serve the largest single reason people still pay for live TV: live sports. If the price is right and the lineup covers the biggest events, it could be the cleanest sports-first play among the mainstream bundles—and a shot across the bow for rivals betting on bigger, pricier packages.